Blog > Long Beach Area Real Estate 2024: Why Local Homeowners Shouldn't Fear a Foreclosure Crisis

Long Beach Area Real Estate 2024: Why Local Homeowners Shouldn't Fear a Foreclosure Crisis

by

By Marvin Phillip, Leading Long Beach Area Realtor with 19+ Years of Experience

Are you a homeowner in Long Beach, Lakewood, or Bellflower worried about today's housing market and foreclosure news? As a real estate expert serving these communities for over 19 years, I'm here to share why our local market remains strong and stable, backed by data and deep market analysis.

Understanding Today's Market: Data Tells the Story

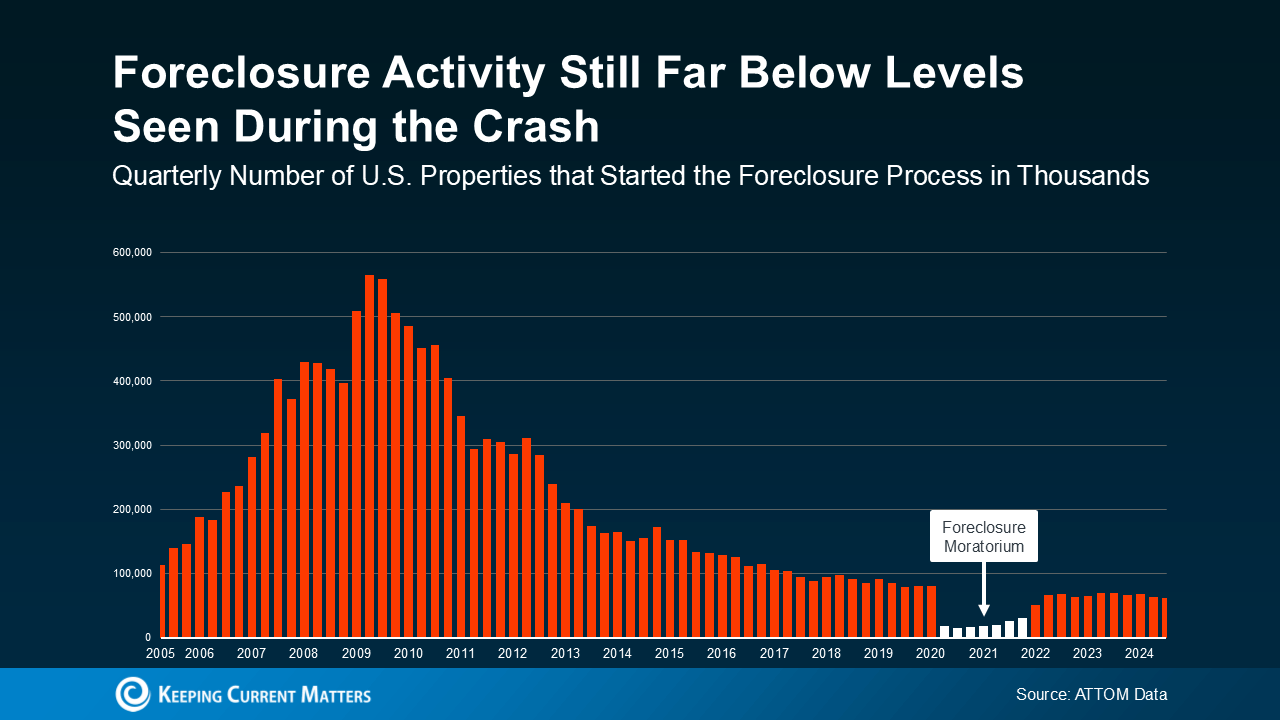

Take a look at this revealing graph from ATTOM Data Solutions:

*Graph Source: ATTOM Data Solutions showing current US foreclosure rates*

What stands out immediately is how today's foreclosure numbers are just a fraction of what we saw during the 2008 housing crisis. This trend is even more pronounced in our local Long Beach, Lakewood, and Bellflower markets.

Local Market Strength: Why We're Different

Strong Property Values and Equity Positions

While the national average for home equity is strong, our local numbers are even better:

- Long Beach homeowners averaging $400,000+ in equity

- Lakewood homeowners with $350,000+ average equity

- Bellflower showing strong equity growth year over year

Stable Local Employment

Our diverse economy provides remarkable stability:

- Port of Long Beach employment base

- Boeing and aerospace sector

- Growing tech presence

- Healthcare industry expansion

- Cal State Long Beach influence

- Strong tourism sector

Long Beach Market Deep Dive

As someone who's guided hundreds of local families through multiple market cycles since 2005, let me break down our key areas:

Naples/Belmont Shore Real Estate Trends

- Average home equity: $750,000+

- Virtually zero foreclosure activity

- Waterfront properties maintaining premium values

- Strong luxury rental demand

- Median price: $1.5M+

- Historic low foreclosure rates

Bixby Knolls/California Heights Market Update

- Historic home values up 18% from pre-pandemic

- Average equity position: $400,000+

- Strong community investment

- Walkable neighborhoods commanding premium

- Median price: $900K+

- Character homes in high demand

Alamitos Heights/Park Estates Insights

- Less than 0.1% foreclosure rate

- High owner-occupancy rate

- Strong appreciation due to school ratings

- Average equity: $500,000+

- Median price: $1.2M+

East Long Beach Opportunities

- Consistent first-time buyer demand

- Strong commuter location

- Average equity: $350,000+

- Excellent price appreciation potential

- Median price: $750K+

- Growing community amenities

Lakewood Market Analysis

Lakewood's market shows remarkable stability:

- Family-friendly neighborhoods in high demand

- Strong school district attraction

- Mid-century homes maintaining value

- Low foreclosure activity

- Steady price appreciation

- High owner occupancy rates

Bellflower Market Trends

Bellflower offers unique opportunities:

- Affordable entry points for first-time buyers

- Growing investor interest

- New development impacts

- Strong rental market

- Excellent price appreciation potential

- Low inventory levels

Economic Drivers Shaping Our Market

Development Impact

- New downtown Long Beach developments

- Broadway Corridor revitalization

- 2028 Olympics infrastructure improvements

- Metro Line expansion plans

- Commercial growth initiatives

Market Indicators

- Average days on market: 21

- Months of inventory: 1.8

- Price per square foot trending up 8% annually

- Multiple offer situations common under $800K

- Strong condo market with 12% annual appreciation

Why This Market Is Different From 2008

As Bankrate explains:

"In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That's not the case now. Most homeowners have a comfortable equity cushion in their homes."

Current Market Opportunities

For Home Sellers

- Strong equity positions

- Multiple buyer demographics

- Low inventory advantage

- Premium pricing for updated homes

- Quick sale potential

For Home Buyers

- More negotiating power

- Rate buydown options

- Off-market opportunities

- Down payment assistance programs

- FHA-friendly options

Expert Guidance for Your Real Estate Decisions

With 19 years of experience serving Long Beach, Lakewood, and Bellflower, I've helped thousands of families make smart real estate moves in every market condition. Whether you're thinking about selling or buying, I can help you understand your options.

Get Your Free Property Analysis

Text "Market Update" to 562-207-8200 for:

- Current market value estimate

- Local market trends

- Equity position analysis

- Selling timeline projection

- Investment opportunities

About Marvin Phillip | Your Local Real Estate Expert

Since 2005, I've been helping families in Long Beach, Lakewood, and Bellflower achieve their real estate goals. My deep understanding of these communities, combined with 19+ years of market expertise, allows me to provide unmatched service to my clients.

Areas of Expertise:

- Long Beach luxury homes

- Lakewood family properties

- Bellflower investment opportunities

- First-time buyer guidance

- Investment property analysis

---

Contact Marvin Phillip:

The Phillip Group

562-207-8200

Instagram@The.Phillip.Group

Serving Long Beach, Lakewood, and Bellflower since 2005

Sources:

- ATTOM Data Solutions

- Keeping Current Matters (KCM)

- Bankrate

- MLS Data

- California Association of Realtors

- Long Beach Economic Development Department

- Local Multiple Listing Service

GET MORE INFORMATION